Theresa Axford Ends Tenure as Superintendent with Major Wins for Monroe County School District

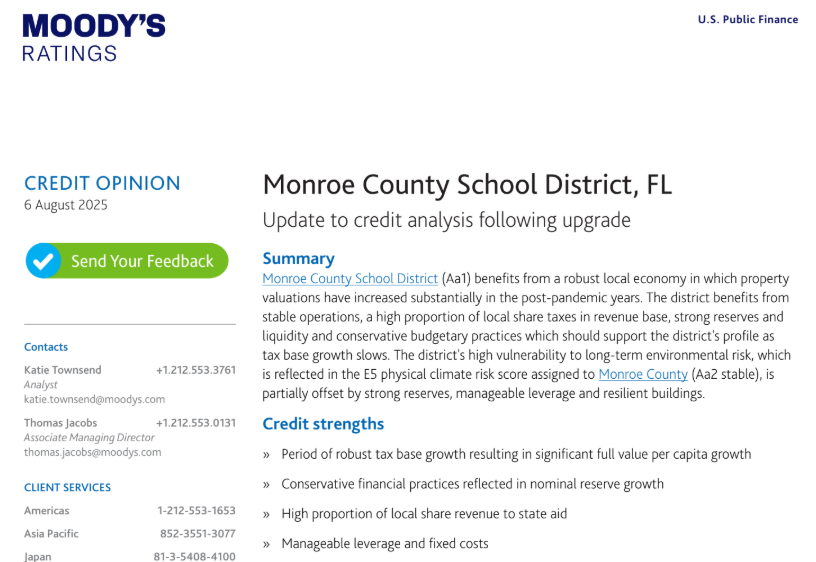

Moody's Ratings has upgraded its long-term credit ratings for the Monroe County School District. The implications of this move are positive for both the district and taxpayers of Monroe County and it can lead to significant financial benefits and increased investor confidence in the district's ability to manage its finances effectively.

"We are proud to announce this ratings upgrade. It reflects the hard work and diligent efforts of the district when it comes to fiscal management of taxpayer dollars," said Superintendent Edward Tierney. “Serving the students, families and citizens of the county by being fiscally responsible is a high priority and this shows we are meeting that challenge,” he said.

Moody's Ratings is one of the major independent bond rating agencies that assess the creditworthiness of entities like corporations, governments, and school districts.

The issuer and sales tax ratings for MCSD were upgraded from Aa2 to Aa1, reflecting Moody's opinion on the district's overall capacity to meet its financial obligations. Aa1 is a high-quality, investment-grade rating indicating a very low credit risk. It is the second-highest rating category, just below Aaa. The "1" modifier further indicates that the district is at the top of the "Aa" category. The Sales Tax rating specifically assesses the creditworthiness of debt secured by sales tax revenues.

The district's COPs rating was upgraded to Aa2 from Aa3. COPs refer to Certificates of Participation, which are a type of debt instrument often used by school districts. The upgrade to Aa2 signifies that the COPs issued by Monroe County School District are also considered high quality and carry very low credit risk.

The implications of the upgrade include:

Reduced borrowing costs: A higher credit rating typically translates to lower interest rates when the district borrows money for capital projects, such as school construction or renovations.

Enhanced investor confidence: The upgrade signals to investors that the district is financially sound and well-managed, potentially attracting a broader investor base.

Improved financial flexibility: Lower borrowing costs can free up resources for other critical needs within the school district, potentially supporting additional investments in education infrastructure.